Stifel North Atlantic AM-Forward Fund is built to address supply chain challenges

Target: Established small Aerospace and Defense manufacturing businesses seeking to grow additive manufacturing (AM) capabilities

STRATEGY

Invest in existing Tier 2, 3, and 4 small business suppliers to leading defense, aerospace, and energy companies

Invest in suppliers (not projects) targeting improved additive manufacturing capabilities

Build capacity for DoD and expand commercial capabilities

FOCUS

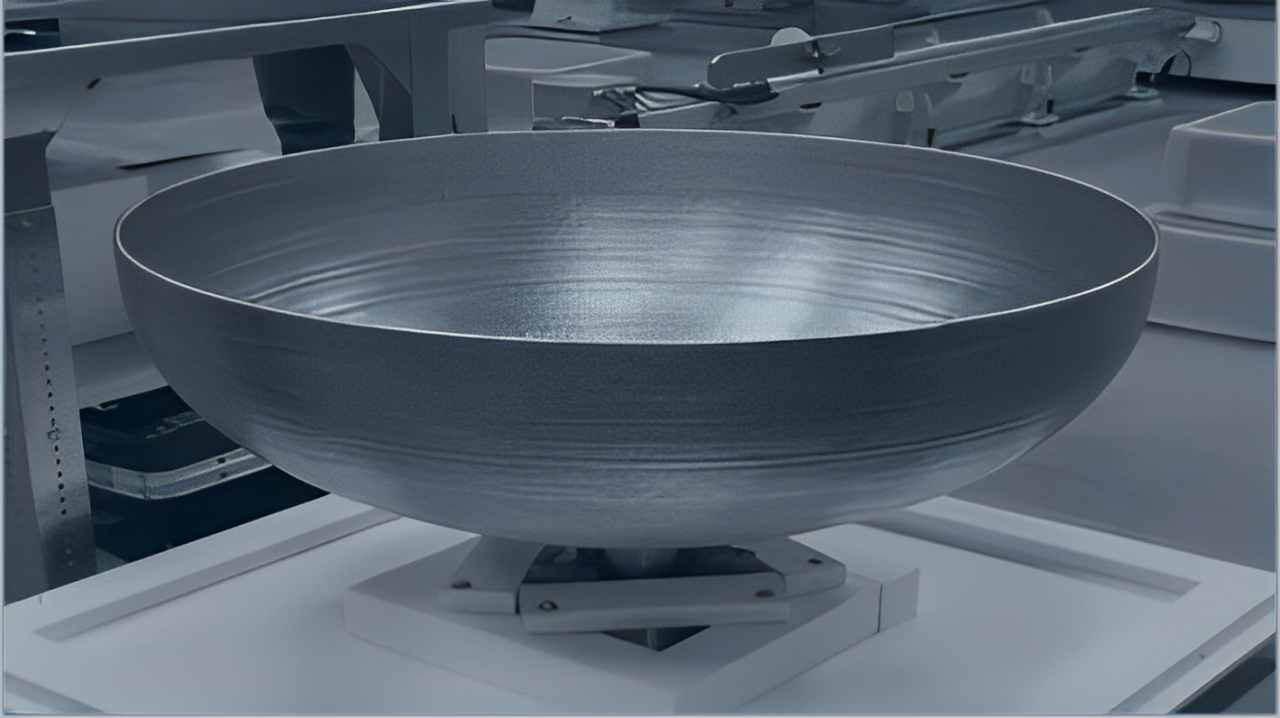

The Fund targets AM adoption and focuses on implementing the full value chain of additive manufacturing, to deliver quality approved parts when needed.

Sample investments may include:

Samples are illustrative only. The Fund may or may not invest in these specific areas.

COMPANY CHARACTERISTICS

Established, U.S.-based manufacturing or related services businesses

Focus on, or interest in, growing aerospace and defense capabilities

Focus on, or interest in, growing Advanced and Additive Manufacturing capabilities

Breakeven to $10 million of EBITDA

INVESTMENT CHARACTERISTICS

Long-term patient capital designed to fit the specific needs of a business

Potential structures include senior debt, subordinated debt, warrants, and minority equity positions

$3 million to $10 million typical investment size, with potential for larger investments with partners

Click here for additional information on the Stifel North Atlantic AM-Forward Fund

This is not an offering for the Fund. A Confidential Private Offering Memorandum (the “Memorandum”) will be available for persons interested in considering an investment in the Fund. The information herein does not constitute an offer to sell any interest in the Fund and is not a solicitation or offer to sell any interest in the Fund. Such an offer will only be made to persons who have received and reviewed the Memorandum and the Amended and Restated Agreement of Limited Partnership of the Fund (the “Partnership Agreement”), who are qualified by the general partner of the Fund (the “General Partner”) as appropriate investors in the Fund, and who have executed all documentation required by the General Partner. You should not make a decision to purchase or commit to purchase any interest in the Fund based on this information. The offer and sale of the LP Interests will not be registered under the Securities Act of 1933, as amended (“Securities Act”), or under applicable state securities laws. The LP Interests are being offered and sold in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, and the offering is designed to comply specifically with the requirements of Rule 506(c) of Regulation D under the Securities Act.